Utilizing Form ADV Filings in Prospect Research

When evaluating a prospect’s capacity, many organizations are familiar with utilizing the “alphabet soup” that is available on SEC EDGAR, or the United States Securities and Exchange Commission Electronic Data Gathering, Analysis, and Retrieval website, but fewer are familiar with the SEC’s Form “Uniform Application for Investment Adviser Registration and Report by Exempt Reporting Adviser”, or Form ADV for short. Form ADV filings can be a goldmine of information for prospect development professionals looking into prospects who are highly involved with an advisory agency or even researching the advisory agency itself.

What is it?

Form ADV is the uniform form used by investment advisers to register with both the SEC and state securities authorities. All organizations providing investment advisory services must file a Form ADV, but organizations managing funds over $25M must also update this form annually. The filings are not on EDGAR, but are available on another SEC website, the Investment Advisor Public Disclosure (IAPD) website, located at https://adviserinfo.sec.gov/.

The Form ADV filing is divided into two parts:

- Part 1 requires an investment adviser to disclose information about business practices, number of employees, affiliated companies, assets under management, ownership, some client numbers, disciplinary action, and much more.

- Part 2 of the filing is called the “brochure” of the firm. At first glance, the brochure looks more focused on the consumer (its intended audience) and therefore one may think less information that could be helpful in our work. However, when diving into the brochure, the organization shares information about fees and how advisers are compensated, types of services offered, conflicts of interest, background information on advisors, history of fines, etc., so it may provide more helpful information on a prospect than one would believe at first glance. Each firm lays out their brochure slightly differently, however there is a table of contents to help guide you to relevant sections.

- Note that until 2019, there was also a Part 3 of the Form ADV filing, which the SEC has since spun off into SEC Form CRS, also known as a “Relationship Summary.” This tends to be the least relevant section of the filing for philanthropic purposes, but you may be able to glean important insights from the relationships disclosed.

How to read it

The Form ADV Part 1 can be hundreds of pages long. Let’s look at a few key sections that provide important information used in our work.

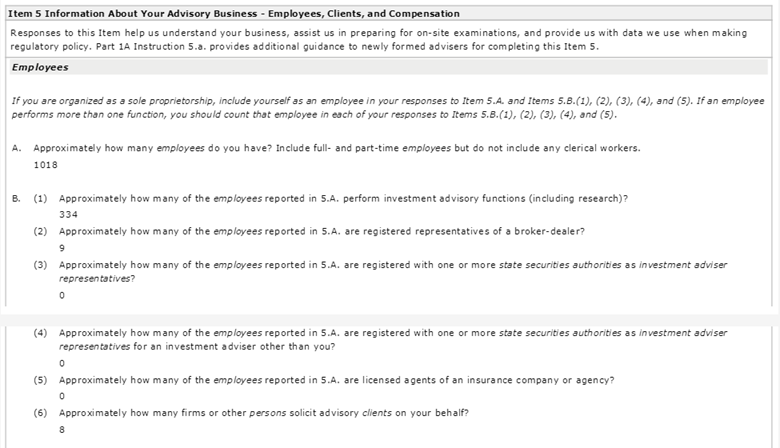

Section 1, Item 5, has a wealth of information. One of the first questions within this section is around the number of employees and the breakdown of their job function. This gives insight into the size and composition of the organization.

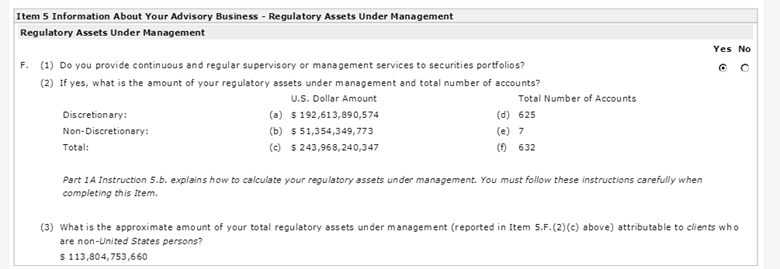

In Item 5, Part D, instead of exploring the number of employees, it explores the client breakdown and includes information about assets under management.

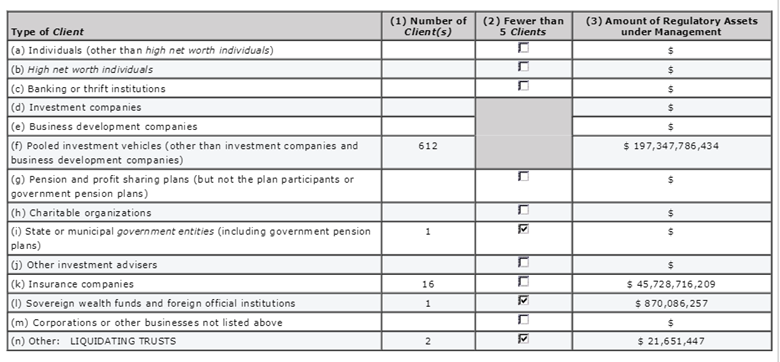

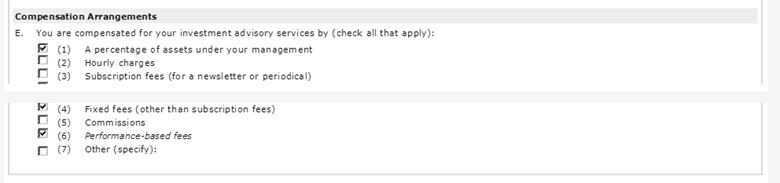

Item 5, Part E, lays out how the firm is compensated for its work, and Part F has more information about assets under management.

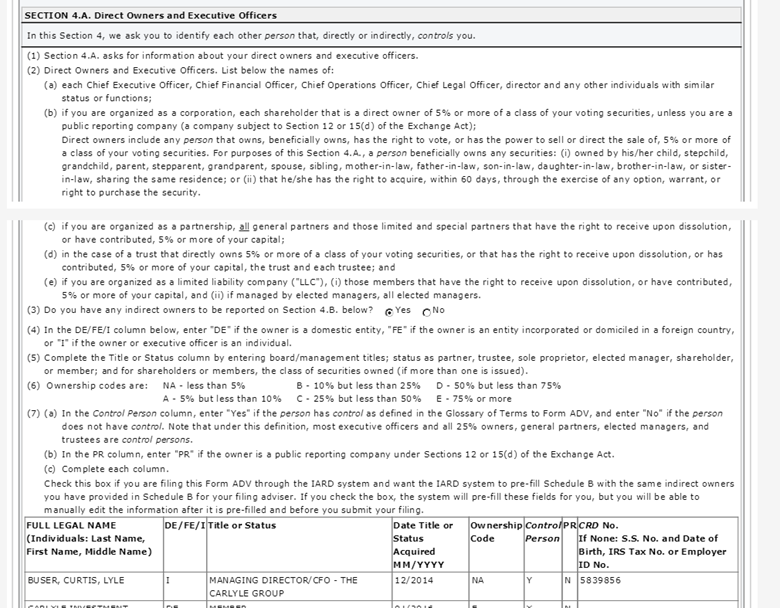

Section 4A & B requires the organization to disclose direct and indirect owners, but also where their ownership lies within a set of ranges. This can be particularly helpful if your prospect is a part owner of the advisory firm in determining their philanthropic capacity.

Beyond the sections highlighted above, the Form ADV filing can provide other vital information on an investment advisory firm and its key stakeholders. As you grow more familiar with the nuances of the forms, they become less intimidating, and you may find other sections with helpful information. We hope this motivates you to add reviewing the Form ADV filing to your arsenal of tools to discover more information about your prospects. Do you have additional questions about using Form ADV filings? Leave them in the comments below or email research@gobelgroup.com.